Consequentialism, Social Justice

Markets and the Economic Condition of the Poor

First, let me thank Matt for inviting me to guest blog this week. I know many of the bloggers here and am a big fan of their work. I also love this blog – both the idea and the execution. And it’s a special treat for me to be among the philosophers and make some use of my “other” undergraduate degree in philosophy. The more I learn about modern philosophy, the more I realize how deeply fortunate I was to have the teachers I had at Michigan in the early 80s. I’m not sure Peter Railton would remember me, but he was the prof for my political philosophy course. So now that my street cred is established, on with the show…

On a plane ride the other day, I finished David Schmidtz’s Elements of Justice, which is a terrific book. I had started it before the whole blog kerfuffle over Nozick began, and that incident prodded me to take it on the plane and finish it. It is, as I don’t have to tell this audience, terrific. I had read Chapter 22 on “Equality and Opportunity” before (thank you Danny), but reading it in full context this time was even better. What I’d like to do in this first guest post is to update some of David’s data and then provide some additional statistics that make his argument about what a market-driven society does for the poorest among us even stronger.

David offers some of the then-recent data on income mobility from Cox and Alm’s 1999 book Myths of Rich and Poor. That data has come under significant methodological fire since then and there has been some additional similar research since. For example, in a Treasury study of income mobility between 1996 and 2005, 58.6% of the lowest quintile moved up at least one quintile in that 10 year period and 29.1% moved up two or more quintiles. A Federal Reserve Bank of Minneapolis study looked at 2001-2007 and found that 44% moved up at least one quintile, with 13% moving up two or more. As David points out, what to conclude from this depends on where you stand. I would say that it shows that income mobility in the US is still alive and well, with at least half of poor families moving up a quintile in around ten years or so, and decent number moving two or more over that same time span. As David also points out, there are all kinds of cautions about these numbers, including issues of household size and “mobility compared to whom?” Whatever one chooses to make of them, I thought I’d provide some more recent data.

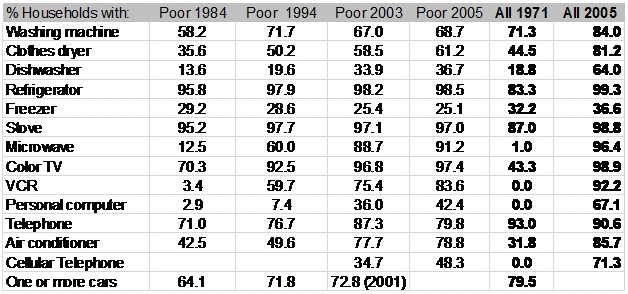

At one point, David makes a quick mention of consumption but then drops it. Well, I want to pick that up. One way of measuring the progress of “the poor” over time is to see what the typical poor household is able to consume in different years. We actually do have some reliable data on this. The Census Bureau surveys US households and asks if they have certain consumer items in their homes. I have tracked this data, both directly from the Census Bureau and from other sources. Here’s what the latest data look like, along with some historical comparisons. Importantly, these are households below the poverty line, not just the lowest quintile. These are the truly poor.

Two things to notice about these data. First, the absolute consumption possibilities of the poor have improved dramatically over time, as the first four columns show. US households below the poverty line have more in their homes than they did in the 1980s or the 1990s, and they have some items that didn’t even exist back then! (And to head off one objection, there is no evidence that this has all been bought on credit.)

Second, compare the poor in 2005 with the “all 1971” column. Americans below the poverty line in 2005 were living better, at least in terms of their ability to buy what we now think of as standard consumption items, than did the average US household in 1971. (Note too that the average household is better off today than in 1971, so much for “the Great Stagnation.”) One might say these are trivial consumption items, but air conditioning and cell phones save lives, and refrigerators and washing machines keep people healthy.

How is this possible? Two answers. First, contrary to what the media say, working and middle class stagnation is a myth. According to the Census Bureau over 30% of US households in 2006 earned above $75,000 compared to under 20% in 1980 (adjusted for inflation). Over the same period, the percentage of US households earning under $35,000 fell from 42.8% to 36.7%. Fewer households are poor, fewer are middle class, and a hunk more are above $75,000. And in case you were wondering, those general trends hold for black and Hispanic households too – with the percentage of black households under $35,000 falling by 10.9 percentage points and the number above $75,000 increasing by 8.9 percentage points, for example. If the middle class is shrinking, it’s because they’re getting richer, as are the poor.

Second, the real cost of goods is falling. Thanks to innovation and competition, it costs far less to buy these household items than in years past, especially if we measure by the number of labor hours it takes to earn the money to buy them. Given the increase in wages over the last few decades and the falling prices of many goods, Americans can buy much more than they could in the past for the same hours of work.

So for example take a $400 TV from 1973 which took 97.1 hours of labor at the average private sector wage of $4.12. At the 2009 wage of $18.72, the 97.1 hours of labor it took to earn that $400 in 1973 would net you $1817.71. So with the same work that would have purchased what, by our standards, was a pretty crappy color TV in 1973, we could today buy a darn-near top of the line very large flat-screen with 3D. Or alternatively, we could go to Walmart and get a relatively cheap LCD TV that would still be a way better product than the 1973 TV and tack onto it a surround sound system, a blu-ray player, and then for giggles maybe a cheap laptop and a small iPod and maybe even a digital camera and still have change left for some DVDs and software. And all of this ignores the increased variety and higher quality of the artistic creations one can enjoy on all of those toys.

So if the question is whether markets work to the benefit of the least advantaged, the answer is “it sure looks that way.” One drive around the rural area in which I live where you can see the working poor with their cell phones, flat screen TVs, and satellite dishes is perhaps all the evidence one needs. If not, you can just quote everything from above.